Princeton’s pioneering financial aid program has benefitted 10,000+ students over last 20 years

Twenty years ago, Princeton made history by becoming the first university in the country to remove loans from its financial aid packages. The decision enabled students to graduate debt-free and opened Princeton’s gates to talented young people who would previously have found the University unaffordable.

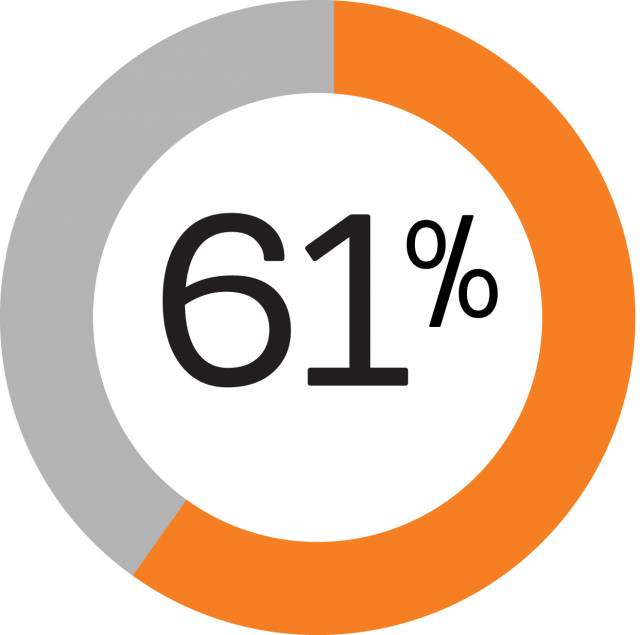

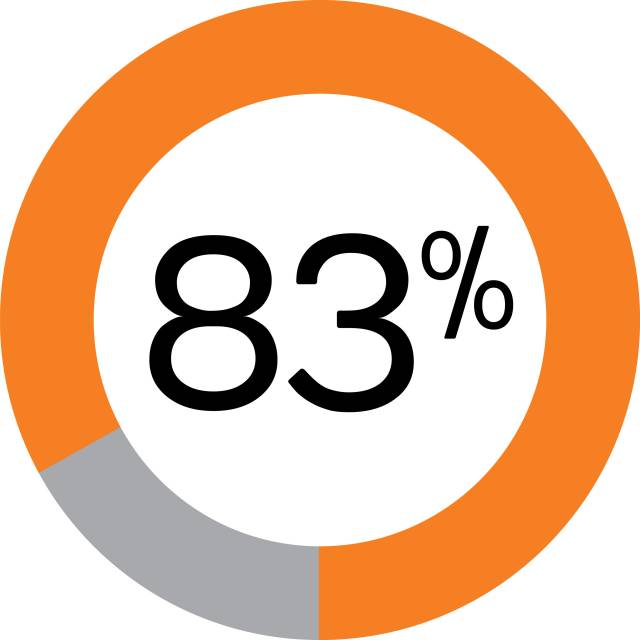

On Jan. 27, 2001, the Board of Trustees voted to replace loans with grants that do not need to be repaid. Today, 83% of seniors graduate with zero debt thanks to Princeton’s pioneering “no loan” financial aid program for undergraduates.

“Affordability and access have become signature commitments for Princeton, and we have attracted spectacular students who would not otherwise have studied or flourished here,” President Christopher L. Eisgruber recently wrote in the Princeton Alumni Weekly.

Financial aid at Princeton is recognized as one of the most generous in the country, and the University’s landmark 2001 decision has had a major impact on higher education.

“People recognized immediately that Princeton had done something extraordinary,” Eisgruber wrote. “‘No loan’ has become a defining benchmark for financial aid programs in American education. At least 20 colleges and universities now meet 100 percent of need for admitted undergraduates without requiring them to incur debt. A much larger number are ‘no loan’ for students below certain income thresholds.”

For families making up to $65,000 per year, Princeton’s average financial aid package covers 100% of tuition, room and board.

Princeton’s financial aid program provides the assistance necessary to make sure that all students, including international students, who are admitted and need financial aid can attend. Over the last 20 years, the University has expanded its commitment to ensuring that a Princeton education is affordable for every student who attends.

Director of Financial Aid Robin Moscato estimates that more than 10,000 students have benefitted from Princeton’s financial aid program during the last 20 years. Moscato said the University had a robust financial aid program before 2001, but the decision to completely eliminate loans was a game changer.

Approximately 61% of Princeton undergraduates receive financial aid.

The impact of Princeton’s 2001 decision to eliminate loans and expand its financial aid program can be observed in many ways. For example:

- Today, approximately 61% of undergraduates receive financial aid. In 2001, only 41% of undergraduates received aid.

- Among recent seniors, 83% graduated debt free. For those who choose to borrow, the average debt at graduation is around $9,400, which is one of the lowest such averages in the country.

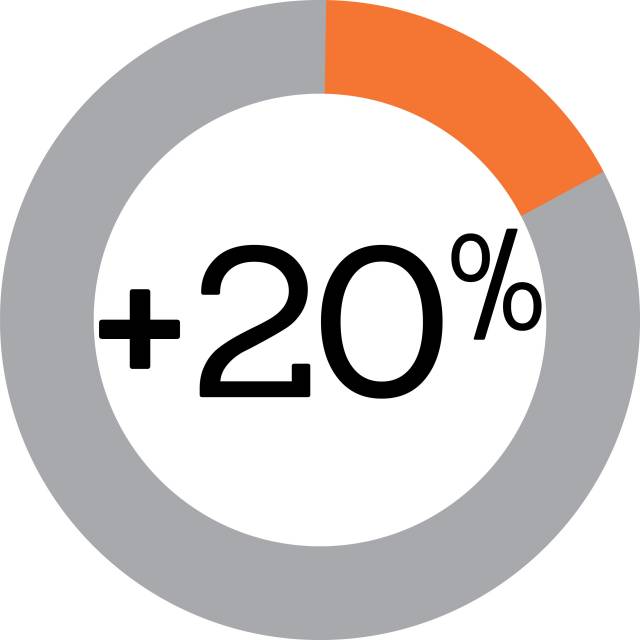

- In the Class of 2024, more than 20% of students are eligible for federal Pell Grants for low-income students — reflecting the University’s enduring commitment to attract, enroll and support extraordinary students from all backgrounds.

- The average financial aid package covers 100% of tuition, room and board for families making up to $65,000 per year.

- 100% of financial aid-applicant families making $180,000 per year or less qualified for financial aid.

Among recent Princeton seniors, 83% graduated debt free. For seniors who chose to borrow, the average total indebtedness at graduation was $9,400.

Moscato, who joined the financial aid office in 1983, has seen firsthand how students, alumni and their families have benefitted. Moscato recalls wearing a Princeton sweatshirt while visiting a Philadelphia hospital, when she happened to get on an elevator with two medical interns.

“The interns said they were Princeton alumni and asked if I was too,” Moscato said. “When I told them I work in the financial aid office, they looked at me and said ‘Oh, thank you!’”

After Commencement in 2010, Moscato received an email from a proud Princeton parent that read: “As I sat under the sun and trees in front of Nassau Hall yesterday morning, I thought of you and all those who carry out Princeton’s extraordinary commitment to financial aid. We are deeply grateful for all that has been done for [our student] and, indirectly, her siblings. Thank you, thank you!”

Moscato said “it’s these small and personal moments, like the one in the elevator, that have meant the most to me.”

Looking toward the future, Princeton’s financial aid budget will grow again when the two new residential colleges open in fall 2022, allowing the University to admit 125 additional students per year. Eisgruber has said the University is committed to meeting the full financial need of every student in the expanded class.

More than 20% of students in Princeton’s Class of 2024 are eligible for federal Pell Grants for low-income students.

Read more:

- Undergraduate Admission and Aid website

- President’s Page in the Princeton Alumni Weekly: “Twenty Years Later: Princeton’s Visionary Financial Aid Program.”

From the archives:

- Princeton University announcement from Jan. 27, 2001: “Grants to replace loans for all students on financial aid.”

- Princeton University feature story from May 24, 2005: “Graduates of first ‘no loan’ class look to the future.”

- Princeton Weekly Bulletin interview with Director of Financial Aid Robin Moscato from Feb. 4, 2008: “Shifts in financial aid follow Princeton’s lead.”